EarlySight is delighted to announce today the first closing of CHF 2.3 million out of a CHF 3 million seed funding round.

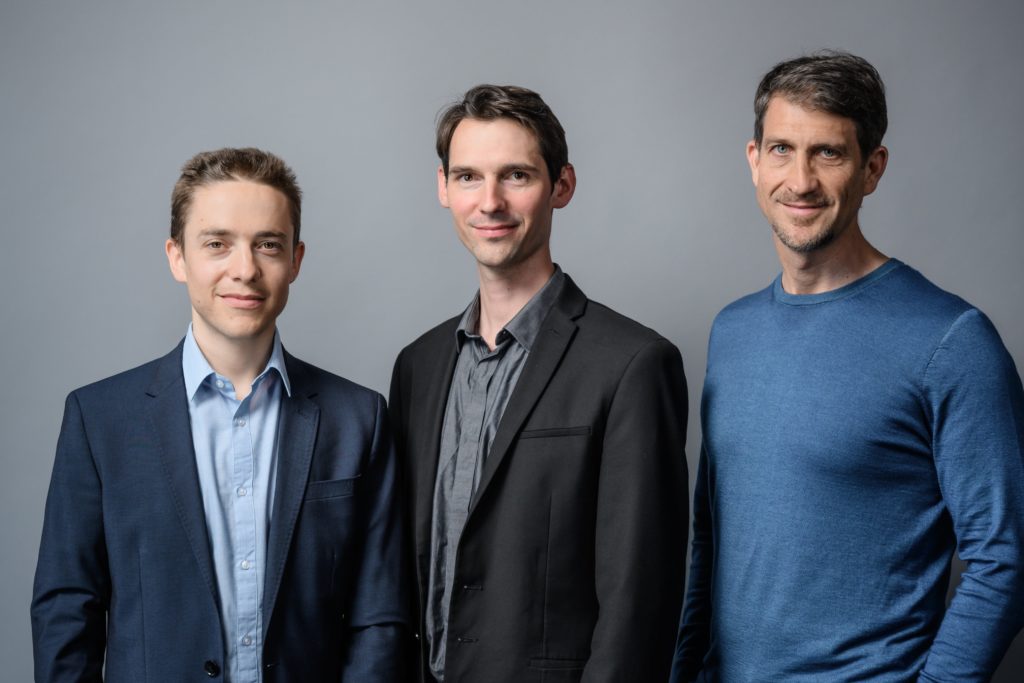

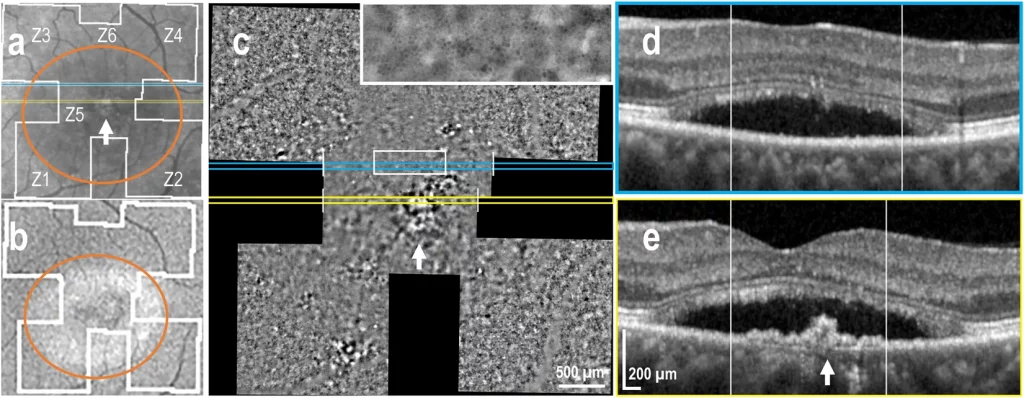

The start-up, which was founded in March 2019, uses a novel approach to provide a single cell level imaging of the back of the eye, called the retina. Its technology combines hardware and software to propose a unique medical device that can observe the cells affected at early-stage of the most prevalent retinal diseases such as age-related-macular degeneration (196 m people affected worldwide), glaucoma (76 m people affected worldwide) or diabetic retinopathy (95 m people affected worldwide), to treat them sooner and more efficiently. Coming out of the Laboratory of Applied Photonics Devices at EPFL, led by Prof. Christophe Moser, the startup has worked in close collaboration with Jules-Gonin eye hospital and Prof MD Francine Behar-Cohen to obtain the first clinical results on patients.

EarlySight was supported by FIT “Fondation pour l’innovation technologique”, Venture Kick and was one of the EIT Health Headstart awardee in 2019.

The round was led by Verve Ventures Other investors in the round include Nina Capital, a European early-stage health tech fund and other private investors who followed a pre-seed investment.

Timothé Laforest, CEO, and co-founder of EarlySight announces: “It’s fantastic to have the support of investors as we aim to grow rapidly and bring EarlySight’s technology to the commercialization level. The capital, knowledge, and network they bring to EarlySight enable us to join the new era of precision medicine in ophthalmology.”

The funds will allow EarlySight to grow the team, optimize its technology and perform additional clinical validations. Thanks to them, important milestones will be reached to prepare the company for market entry.

“We are delighted to receive strong support from investors who share our vision. They understand that today’s care of retinal diseases is not satisfactory and needs a strong push forward. Their expertise in MedTech companies will accelerate the development of our product so that doctors and patients can benefit from it as soon as possible.” Says Mathieu Kunzi, CTO and co-founder of EarlySight.

“The need for deeper understanding and earlier diagnosis of retinal diseases is only going to increase with the current trends of an aging population. Earlysight has the right ingredients to address this need. We are thrilled to back the Earlysight team and look forward to continuing the journey with them and supporting them in achieving our shared vision”. Sebastian Anastassiou, Nina Capital.

“Preliminary results indicate a large window of action between the early onset of the disease and current diagnosis timing, thus confirming the clinical use case. EarlySight is also very relevant for pharmaceutical development, as the lack of objective clinical endpoints has made the development of early treatment difficult. Overall, EarlySight really has the potential to be the next breakthrough technology in retinal imaging, in the same way, that OCT was 20 years ago”, says Susanne Schorsch, Investment Manager at Verve Ventures.

The seed round remains open until July for a second closing with an additional CHF 600k investment. For more information, please contact us at contact@earlysight.com.

Verve Ventures is a network and technology-driven venture capital firm based in Switzerland and one of the most active venture investors in Europe with over 100 science and technology-driven startups in its portfolio. Selected private and institutional investors get access to investment opportunities through a digital platform. The company invests EUR 0.5 million to several million from the Seed Stage onward in startups across Europe. Verve Ventures’ dedicated team helps startups with their most pressing needs such as hiring, client introductions, and an expert network of high-profile individuals. To join Verve Ventures’ growing pan-European community of entrepreneurs and investors, visit verve.vc.

Nina Capital is a European venture capital firm focused on early-stage investments in health technology companies. They invest in need-driven founders inspired by a vision for the future in which data, computing, IoT, and deep technologies deliver meaningful outcomes and insight for improving health and the provision of care. More on them at nina.capital.